Understanding the habits that influence your financial situation can help you make better choices with money. Many people wonder what sets wealthy individuals apart from those who struggle financially.

The key difference often lies in specific money habits that guide how you earn, save, and spend. By recognizing and adopting these habits, you can work toward greater financial stability and success.

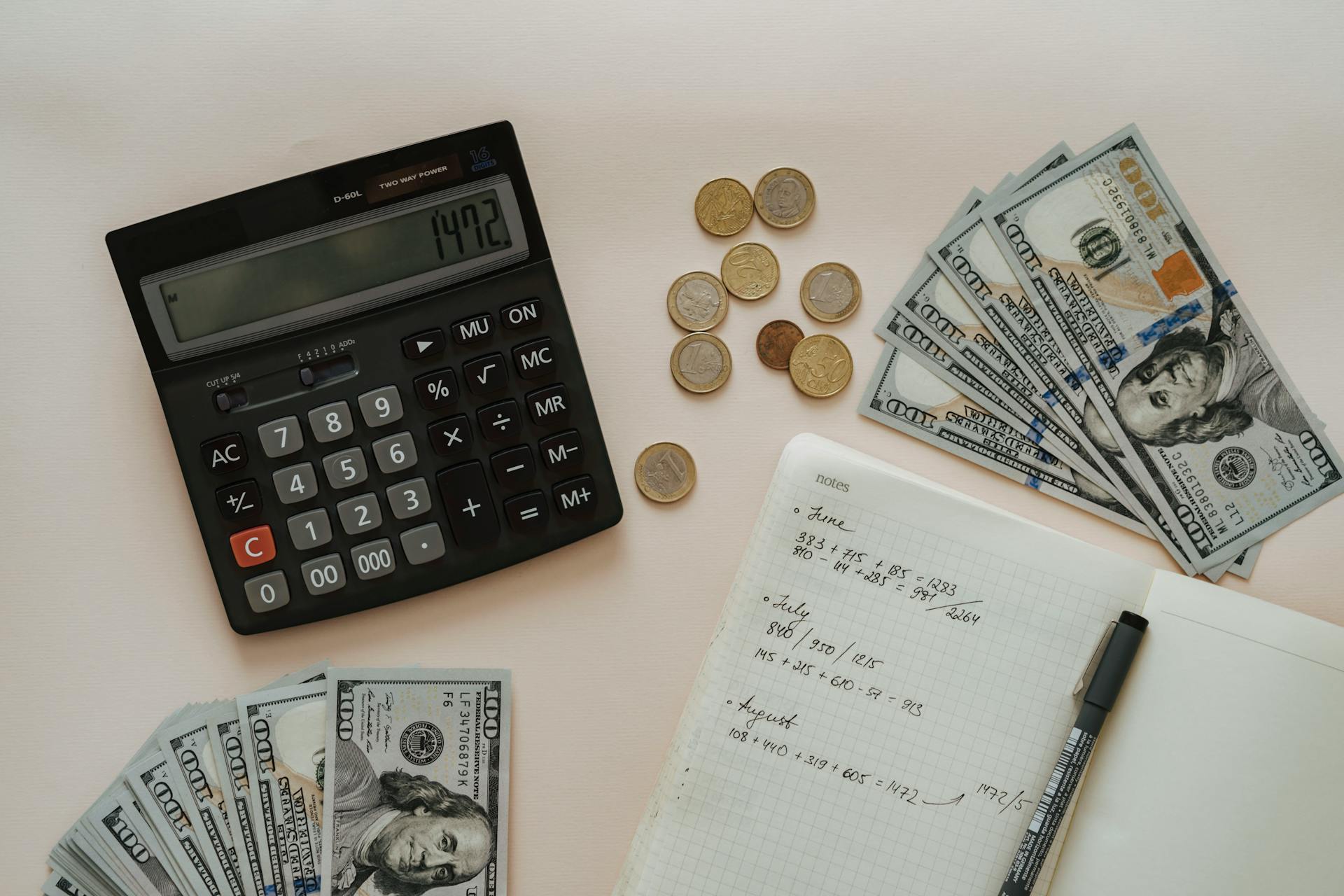

Tracking all expenses meticulously

You need to know exactly where your money goes. Tracking every expense, even the small ones, helps you spot patterns and areas to cut back.

Use a notebook or an app to record each purchase daily. This habit keeps you aware and in control of your spending.

By tracking consistently for at least a month, you build a clear picture of your financial behavior. It’s a simple step that can lead to better budgeting and saving.

Setting clear long-term financial goals

You need to know exactly what you want to achieve with your money. Clear goals help you stay focused and make better decisions.

Think about where you want to be in 5, 10, or 20 years. This could be saving for a home, retirement, or starting a business.

When your goals are clear, it’s easier to create a budget and track your progress. This keeps you motivated and on the right path.

Budgeting every month without fail

You build control over your money when you budget each month consistently. It helps you see where your money is going and plan for expenses without surprises.

Sticking to a budget lets you avoid unnecessary debt and focus on saving. It doesn’t have to be complicated—tracking your income and spending gives you clear insight.

By budgeting regularly, you create habits that support smart decisions. This steady approach is common among people who grow their wealth over time.

Consistent investing, even with small amounts

You don’t need a lot of money to start investing. What matters most is making it a regular habit. Small contributions over time can grow steadily.

Automating your investments helps keep this habit consistent. It removes the stress of decision-making and keeps you on track. Even modest amounts, invested wisely, can build your financial future.

Avoiding impulse purchases through pauses

When you pause before buying, you give yourself time to think. This simple habit helps you avoid spending on things you don’t really need.

Waiting even a day can change whether a purchase feels necessary. It lets you focus on your bigger financial goals instead of temporary wants.

By resisting impulse buys, you keep more money available for saving and investing. This small step can make a noticeable difference over time.

Diversifying income streams

You don’t have to rely on just one source of income. Building multiple streams helps protect you if one slows down or stops.

Think about side projects, investments, or passive income like royalties or rental properties. These can add stability and grow your wealth over time.

Starting small is okay. The important part is to keep exploring ways to bring in money beyond your main job.

Continuous learning about personal finance

You should make learning about money a regular habit. Understanding topics like budgeting, investing, and taxes helps you make better decisions.

Reading books, following trusted financial experts, or taking courses can keep your knowledge fresh.

Your financial situation and the economy change over time. Staying curious helps you adapt and improve how you manage your money.

Networking with financially savvy people

You benefit when you connect with people who understand money well. Their knowledge can help you see opportunities and avoid common mistakes.

Spending time with financially savvy individuals encourages you to adopt smarter habits. You learn new ideas about saving, investing, and managing debt.

Building a network like this takes effort, but it can support your growth. Surrounding yourself with the right people influences how you think about money and your financial goals.

Using smart debt management strategies

You can use debt as a tool, not a trap. Paying off credit card balances in full each month helps you avoid costly interest fees.

Managing your debt means recognizing patterns, not just balances. Changing how you handle money is key to breaking the cycle.

Smart debt management lets you build credit and invest in opportunities without getting overwhelmed by payments. Keep control by staying organized and paying on time.

Prioritizing saving before spending

You should treat saving money like a regular bill you have to pay. By putting money aside first, you make sure your future needs come before any extra spending.

This habit helps you build a safety net and avoid getting caught off guard by emergencies. When you pay yourself first, it’s easier to resist impulse purchases.

Saving before spending gives you more control over your finances and keeps you on track toward your goals.

Maintaining an abundance mindset

You start by believing there is enough wealth and opportunity for everyone. This mindset shifts your focus from scarcity to possibility.

Give freely when you can, whether it’s time, money, or help. Sharing creates a flow of positivity and opens doors for more abundance in your life.

Remember, abundance isn’t just about money; it’s about appreciating what you have and trusting more will come your way. Keep practicing this mindset daily.

Regularly reviewing and adjusting financial plans

You should make it a habit to review your financial plan regularly. Life changes, and your plan needs to keep up with your goals and circumstances.

Checking your budget, investments, and debts every few months helps you spot problems early. Adjusting your plan based on these reviews keeps your money working efficiently for you.

Don’t be afraid to change your strategy if something isn’t working. Staying flexible and proactive is key to maintaining control over your finances.

Building emergency funds

You need a cash reserve set aside for unexpected expenses. This fund helps you avoid debt when emergencies arise.

Start by saving a small amount regularly. Even $1,000 can provide a financial cushion.

Building your emergency fund takes time, but it gives you stability and peace of mind. Keep contributing until you have three to six months’ worth of expenses saved.