Adulting often feels more complicated than it needs to be, and sometimes the smallest missteps can add unexpected stress to your daily life. Managing responsibilities like bills, schedules, and relationships becomes overwhelming when simple habits or decisions create hidden challenges.

By identifying and adjusting a few tiny mistakes, you can make your journey through adulthood smoother and less exhausting. Understanding these common pitfalls helps you regain control and build confidence as you navigate grown-up life.

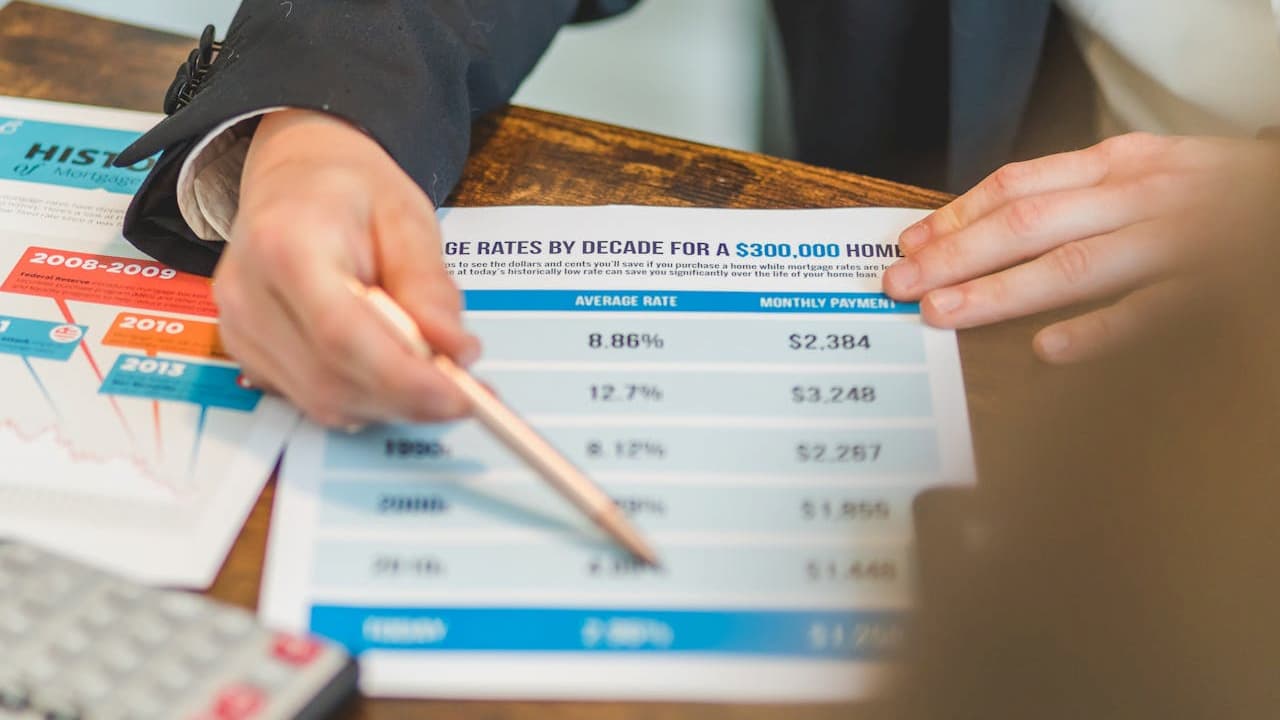

Ignoring a simple monthly budget plan

When you skip setting up a monthly budget, it’s easy to lose track of where your money goes. Without a plan, small expenses add up and can cause stress later.

A simple budget helps you see your income, bills, and spending clearly. It gives you control and helps avoid surprises like missed payments or running out of cash.

You don’t need a complicated system. Just tracking your regular expenses every month helps you stay on top of your finances and make smarter choices.

Not setting reminders for bill payments

If you don’t set reminders for your bills, it’s easy to forget when payments are due. Missing deadlines can lead to late fees and even hurt your credit score over time.

Using reminders gives you a simple way to stay on top of your finances. You can set alerts days before a due date, giving yourself enough time to pay on schedule.

Automatic payments are another option to consider. They remove the guesswork and help you avoid late payments without needing constant attention.

Skipping meal prep leading to wasted food

When you skip meal prep, it’s easy to lose track of what food you have. This often leads to forgetting leftovers or fresh ingredients that spoil before you use them.

Without a plan, you might buy more than you need or grab quick takeout instead of using what’s available. This creates unnecessary waste and costs more in the long run.

Taking a little time to prep meals can save you money and reduce waste. Plus, having ready-to-eat options makes choosing healthy food easier throughout your busy week.

Avoiding small social check-ins with friends

You might think skipping quick messages or calls won’t matter. But small social check-ins help keep connections strong without much effort.

When you avoid these brief check-ins, friends can feel forgotten or less valued. It’s not about long conversations, just a simple “How are you?” or sharing a small update.

These little moments build trust and show you care. Making time for them can make adulting feel less isolating and keep friendships alive.

Neglecting to create a basic emergency fund

If you don’t have a small emergency fund, unexpected expenses can quickly derail your finances. Even minor emergencies like car repairs or medical bills can become stressful without any savings set aside.

Starting with just a few dollars regularly can build a helpful cushion over time. Keep this money separate from your regular spending accounts to avoid using it for non-emergencies.

Having an emergency fund protects you from debt and financial stress. It gives you a simple safety net when life throws a surprise your way.

Putting off scheduling annual health checkups

You might think skipping your yearly checkup saves time, but it can actually make things harder later. Regular checkups help catch hidden health issues before they become serious.

Delaying these appointments increases the chances of missing important screenings. If you have chronic conditions, staying on top of checkups is even more important.

Scheduling your annual visit doesn’t have to be stressful. Small, realistic steps can help you prioritize your health without it feeling like a big chore.