An 83-year-old Dallas grandmother who thought she had lost nearly $15,000 to check fraud has finally seen her savings restored after her story drew widespread attention. The reversal capped months of frustration with Wells Fargo and turned a private financial nightmare into a public test of how major banks treat older customers when something goes wrong.

Her case, which began with a single altered check, evolved into a broader debate over deadlines, fine print, and the power of media scrutiny to force a global financial institution to revisit a decision it had insisted was final.

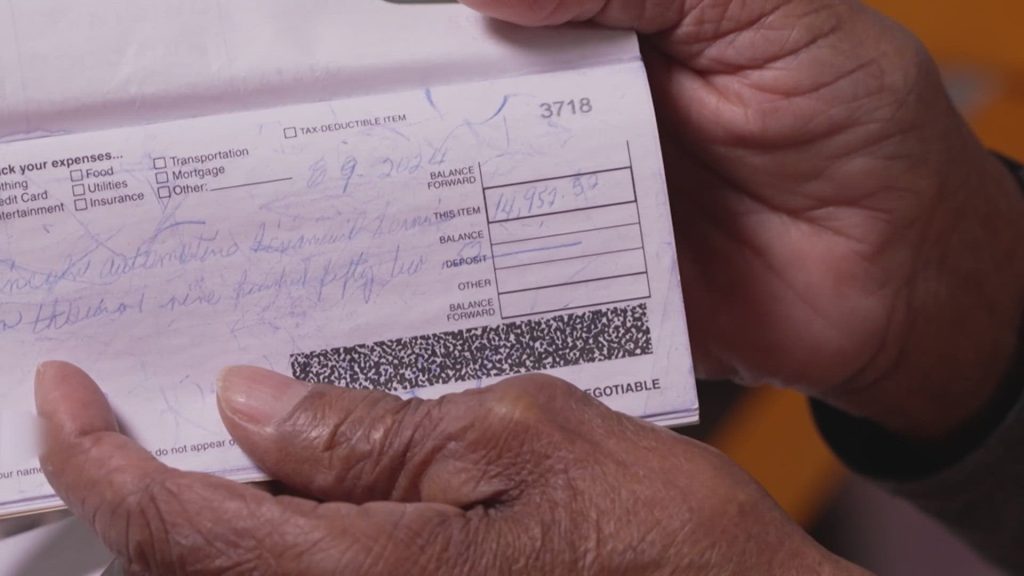

The altered check that drained an elderly saver’s account

The trouble started when 83-year-old Billie Young, a longtime customer in Dallas, wrote a check that never reached the person she intended to pay. Instead, the check was intercepted and altered, and nearly $15,000 disappeared from her account before anyone in her family realized what had happened. By the time relatives pieced together the missing funds, the money had already been withdrawn by someone Young had never met, leaving the retiree stunned that a routine payment could morph into a life-altering loss.

Video shared of the case shows how the original check was changed and then processed, with the altered amount clearing through her bank even though the payee and handwriting did not match what Young had written. In one clip, a reporter walks through how the check was altered and cashed, underscoring how a single piece of paper can become a gateway for fraud when it passes through multiple hands and systems before anyone notices something is wrong.

Wells Fargo’s denial and the 30-day deadline

When Young and her family reported the theft, they expected Wells Fargo to treat the incident as clear-cut fraud and credit the money back. Instead, the bank denied her claim, arguing that she had missed a 30-day deadline to dispute the transaction after it appeared on her statement. The decision left the 83-year-old responsible for nearly $15,000 that had been siphoned away by a stranger, even though she had not authorized the payment and had no relationship with the person who cashed the altered check.

Coverage of the case described how a Dallas woman lost nearly $15,000 after Wells Fargo denied her fraud claim on the grounds that she did not meet the 30-day reporting requirement. Additional reporting on the bank’s handling of the altered check detailed how the 83-year-old Dallas woman’s account was left exposed after the check was changed and processed, with the bank’s decision effectively shifting the cost of the crime onto a senior customer rather than absorbing it as a fraud loss.

A Texas grandmother’s fight goes public

As the denial sank in, Young’s story began to spread beyond her immediate circle. Her family shared her experience with local journalists, and soon the case of an 83-year-old Dallas woman whose check had been altered was being discussed across Texas and beyond. One report described how the bank’s refusal to reimburse an 83-year-old Dallas woman for nearly $15,000 stolen through check fraud raised alarms about how similar disputes might be handled for other customers, especially those who are older and may not check online statements every day.

Social media posts amplified the story, with one widely shared clip describing an elderly Dallas woman who said Wells Fargo had refused to reimburse her after she called her bank for answers. Another post framed the case as an example of a bank refusing to help an 83-Year-Old Black Grandma, naming Billie Young and emphasizing that the money had gone to someone she had never met. The language reflected the anger many viewers felt as they watched an older Black woman navigate a complex dispute with a national bank.

National attention and a wave of support

Once the story reached a wider audience, messages began pouring in from across the country. People who saw the coverage of the 83-year-old’s ordeal reached out to her family, sharing their own experiences with disputed transactions and offering to help. In Dallas, the family of Kecia Byars, who had also been affected by a bank dispute, described how people responded after seeing a similar case, with messages coming by and people asking how they could donate through GoFundMe. That groundswell of support for another elderly customer showed how quickly viewers were willing to rally around seniors who felt abandoned by their banks.

National outlets also picked up Young’s story, framing it as part of a broader pattern. One report described a Texas grandmother, 83, who said Wells Fargo had heartlessly refused to reimburse her for $15K that fraudsters ripped off, highlighting how the Texas grandmother, 83, and her family had shared correspondence showing the bank’s firm stance. A related account of the same case emphasized again that a Texas grandmother, 83, had accused Wells Fargo of refusing to reimburse her for $15K, citing correspondence reviewed by her relatives that documented the bank’s denial.

Media pressure forces a reversal

The turning point came after sustained local coverage focused squarely on Young’s case. Reporters detailed how Wells Fargo had denied the fraud claim after her check was altered, and how the decision left an 83-year-old Dallas woman without reimbursement despite clear signs of tampering. One investigation into how Wells Fargo denies after an 83-year-old Dallas woman’s check is altered raised broader questions about whether seniors are being left to shoulder fraud losses without meaningful recourse.

Within days of that scrutiny, Wells Fargo reversed course. The bank restored nearly $15,000 to Young’s account, effectively undoing the earlier denial and acknowledging that the fraud loss should not fall on her shoulders. Coverage of the reversal noted that Wells Fargo reversed and that the Dallas grandmother got nearly $15,000 back, a result that came only after her case was spotlighted in detail. A follow-up report underscored that Wells Fargo reversed its fraud decision days after a high-profile report, with the bank restoring her savings and effectively walking back its earlier denial of her.

How other seniors have faced similar battles

Young’s ordeal did not occur in isolation. Other older customers have described similar experiences, where disputed transactions collided with strict deadlines and complex procedures. One report detailed how an 83-year-old Black grandmother in Dallas said Wells Fargo denied her $15,000 fraud claim because her report came in late, according to her family, echoing the same 30-day rule that had initially blocked Young’s reimbursement. The pattern suggests that seniors who do not monitor digital statements daily may be particularly vulnerable when fraudsters strike.

Another account described how, in May, Wells Fargo refused to reimburse an 83-Year-Old whose check had been altered, with the bank citing its internal fraud claim rules. A separate summary of the Dallas case noted that KYTX in Tyler and Longview highlighted how KYTX Tyler Longview had covered related disputes, including one involving a Navy veteran with prostate cancer, underscoring that the stakes are often highest for people already facing health or financial challenges.

What the reversal reveals about bank policies and public pressure

Wells Fargo’s decision to restore Young’s savings after intense scrutiny highlights the tension between rigid internal rules and public expectations of fairness. On its own website, the bank promotes a wide range of consumer services, from checking accounts to fraud monitoring tools, presenting Wells Fargo as a trusted partner for everyday banking. Yet the initial refusal to reimburse an elderly customer for an obviously altered check raised questions about how those promises translate when a vulnerable person is caught in a sophisticated scam.

The outcome also shows how media coverage can change the trajectory of an individual case. After WFAA brought attention to 83-year-old Billie Young’s situation, After WFAA highlighted her story, Wells Fargo reversed its decision and restored her savings, a sequence that underscores how public pressure can prompt a large institution to revisit a case it had previously closed. A separate social media update noted that a Texas grandmother, 83, who had accused Wells Fargo of refusing to reimburse her for $15K would now be able to use the restored funds to pay off her, a reminder that behind the policy debates are concrete needs like transportation, medical bills, and day-to-day living expenses.

More from Decluttering Mom: